How does the GTT feature work?

GTT stands for Good Till Trigger. They are triggered condition order in which you need to set condition and when your set condition is completed your order will go to the exchange and on the set Limit Price or Market Price it will get executed.

GTT orders are valid for next 365 days or till it gets triggered.

A GTT is a trigger which places a limit order or market price order (at the limit price or market price, selected by you) as and when the trigger price, selected by you, is met or breached. In case the trigger price is breached during a particular day and the limit price selected is not exactly met on the same day, all such orders will be cancelled at the end of such trading day session.

The trigger set on GTT is valid only once, if the order is placed and is not executed for any reason, the GTT order has to be replaced again.

If the Last Traded Price (LTP) of a scrip jumps than the trigger price selected, or if the LTP opens at a gap up or gap down breaching the selected trigger price, an order would be placed at the selected limit price. GTT Order will be placed when normal market opens. GTT will not participate in preopen market.

Terms of Usage - Good Till Trigger (GTT)

These Terms of Use govern the usage of services of the GTT Feature. By agreeing to use this GTT Feature terms, you agree to have read and understood these clauses, conditions, the modalities of how the GTT Feature clearly works, and ProStocks’s policies, procedures and risk disclosure documents.

Definitions

- “Good Till Trigger Feature” or “GTT Feature” shall be defined as per "GTT Feature as a Service".

- “Last Traded Price” or “LTP” is the last traded price at which a stock/scrip was traded on the Exchange and received by our server.

- “Limit Order” , "Market Order" , "Stop Loss order" , "Stop Loss market Order" or order shall be defined as per the NSE “Order Conditions” which can be found here.

- “RMS” or “Risk Management System” is the system in place at ProStocks which monitors all positions of ProStocks clients on a real time basis and sees to it that clients maintain margins with respect to all positions/positional trades and that ProStocks maintains margins at a broker/trading member level with the clearing houses. The RMS also constantly vets each order, on a pre-trade basis, placed by a client towards the exchanges to see whether the order is as per ProStocks’s risk management policies and procedures, and whether the client has placed such order with sufficient cash balances, holdings and as per the rules set by and the Exchanges. The RMS continuously enforces ProStocks’s terms, policies and procedures, by enforcing limits of margins/squaring off positions with respect to each client, as per the risk management policies followed by ProStocks. You, as a client, are required to always be updated with ProStocks’s risk management policies, terms, and procedures.

“Trigger Condition” shall mean the criteria and conditions entered by You, which if met, the corresponding order entered by you will be placed on the exchange. The below set of conditions, not being limited to, are required to be selected by You:

A Trigger Price (defined as per Clause 4)

Type of order: You will be able to select Limit Order, Market Order, Stop Loss order and Stop Loss market Order as a type of order for your using the GTT Feature.

A Limit Price: the price selected by you, which places a limit order at the price selected by you after the Trigger Price is met or breached.

A Market Order: Place market order to buy or sell order at best available price in the market. Mostly, a market order gets executed instantly because its matching order is already in the queue.

A Stop Loss Order: Place stop loss order to avoid loss (beyond a desired level) by the order which has been already placed. Stop loss is a conditional order, where the condition is the price level or ‘trigger price’ at which it becomes active and starts acting as a normal order.

“Trigger Price” shall mean the price entered by you to trigger an order and place it on the exchange while using the GTT feature. This price selected by You may either be:

All prices entered by You for Your Trigger Price shall be tracked against the Last Traded Price (LTP) of the stock/scrip received by server of the ProStocks.

The price selected by you as a Trigger Price, for stocks/scrips having a market price greater than Rs. 50, must be 2 % away from the current market price of the stock.

The price selected by you as a Trigger Price, for stocks/scrips having a market price lesser than Rs. 50, must be 25 to 50 paisa away from the current market price of the stock.

- “You” or “Your” or “Yourself” shall mean you, the client, having a trading and demat account i.e., a Client ID, with ProStocks and using the GTT Feature placement services from your ProStocks Star trading terminal through either Star Web or the Star Mobile Application.

GTT Feature as a Service

“Good Till Trigger Feature” or “GTT Feature” or “GTT” is a feature which allows You to set certain Trigger Conditions; such that, as and when such Trigger Conditions are met, an order as per the Trigger Conditions set by You would be placed on the Exchanges.

By using the GTT Feature, there is no actual order placed, until and unless the Trigger Conditions, as set by You are met. ProStocks stores the Trigger Conditions, as set by You, and places an order to the Exchange as and when the Trigger Conditions are met.

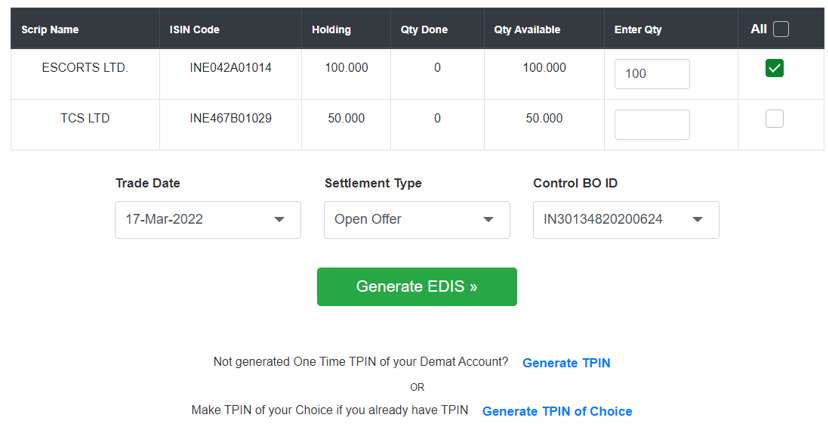

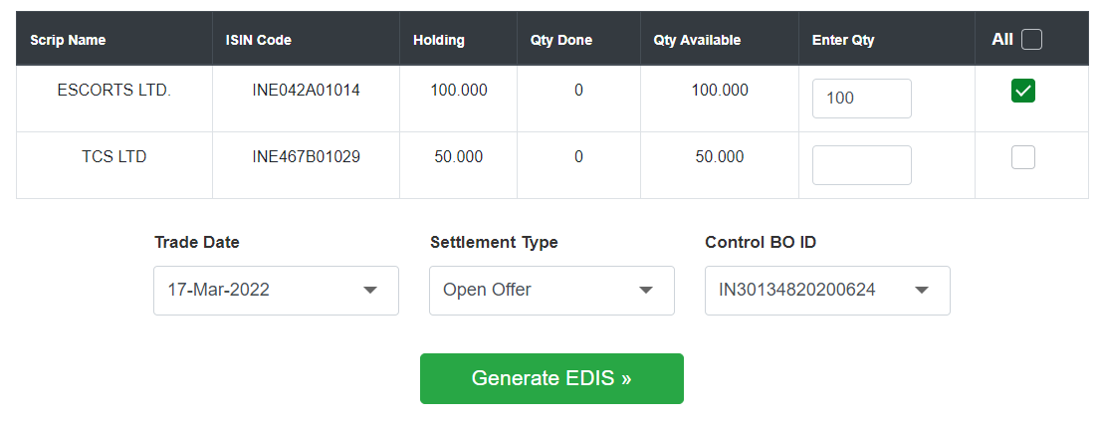

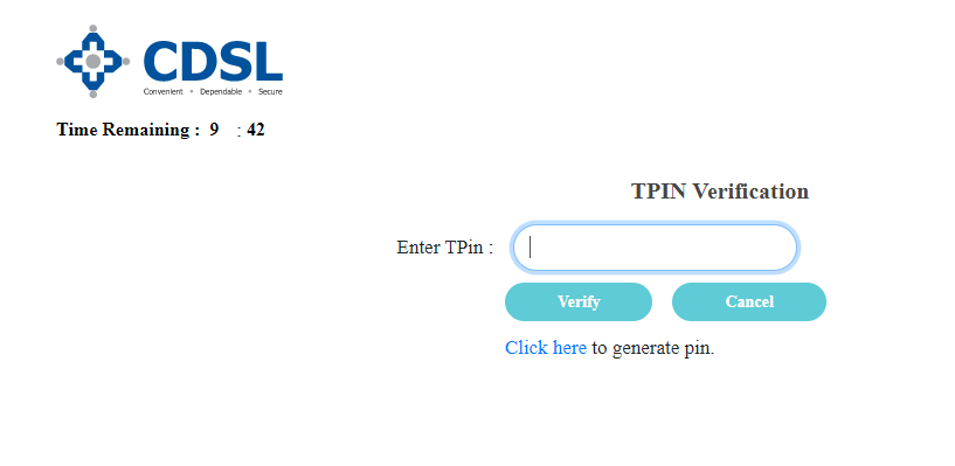

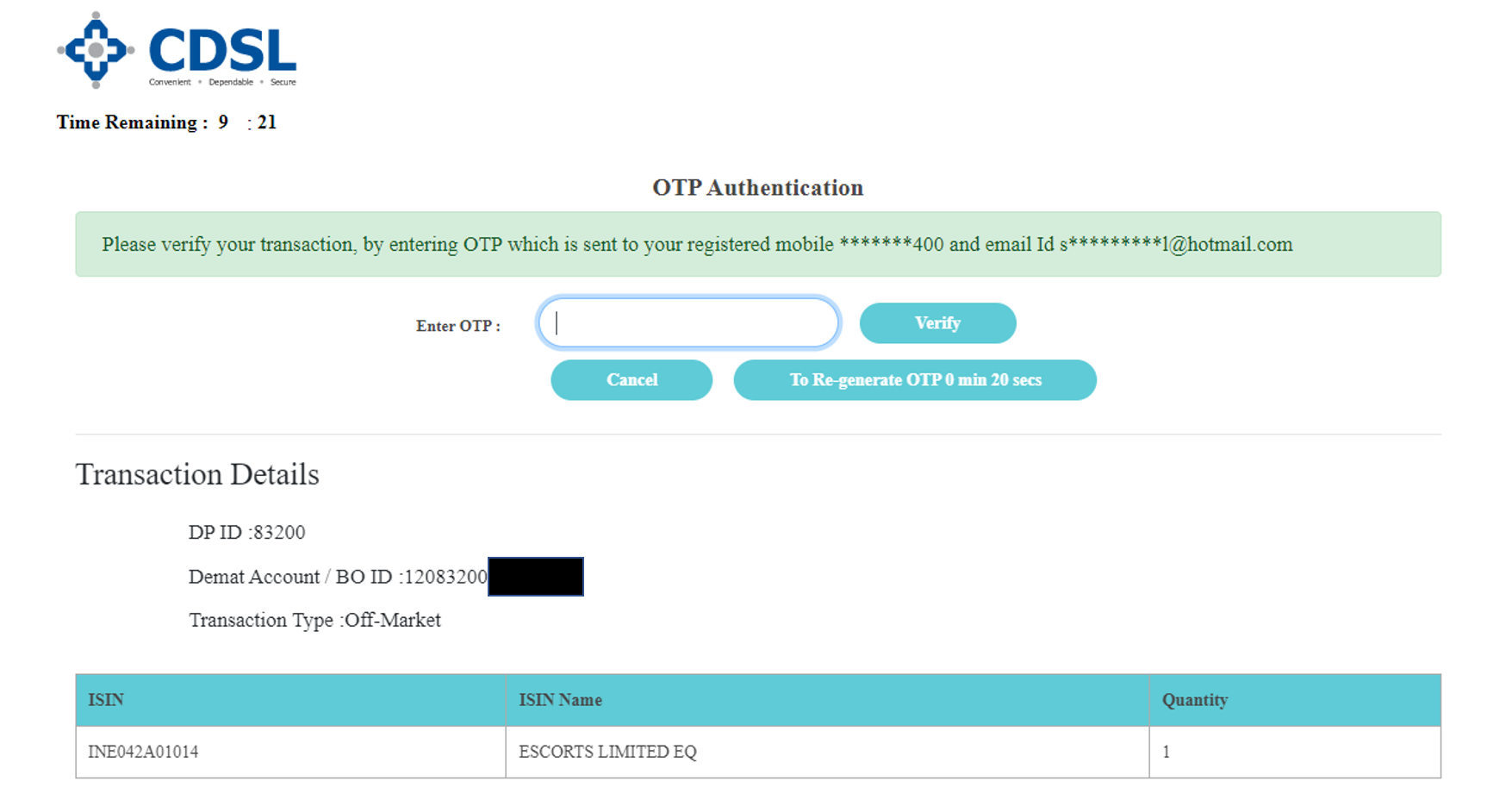

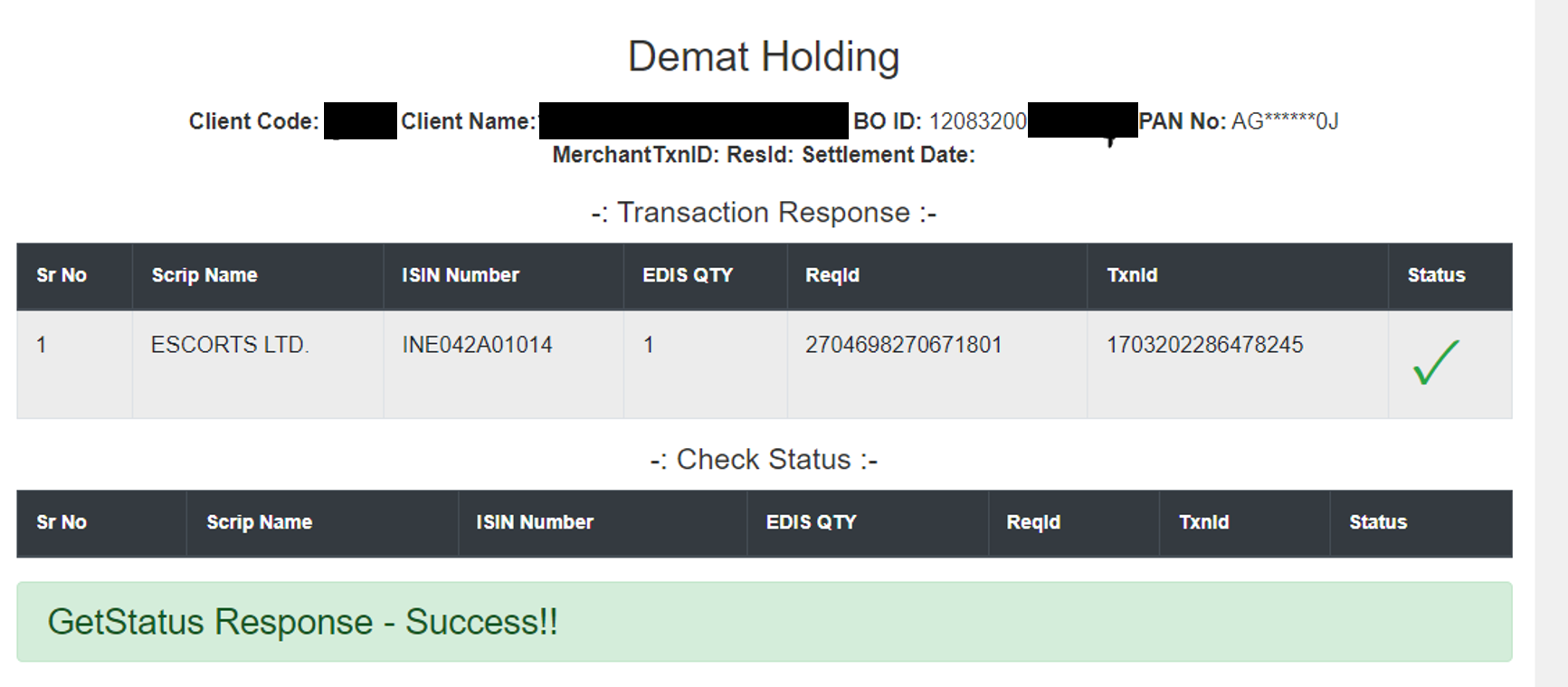

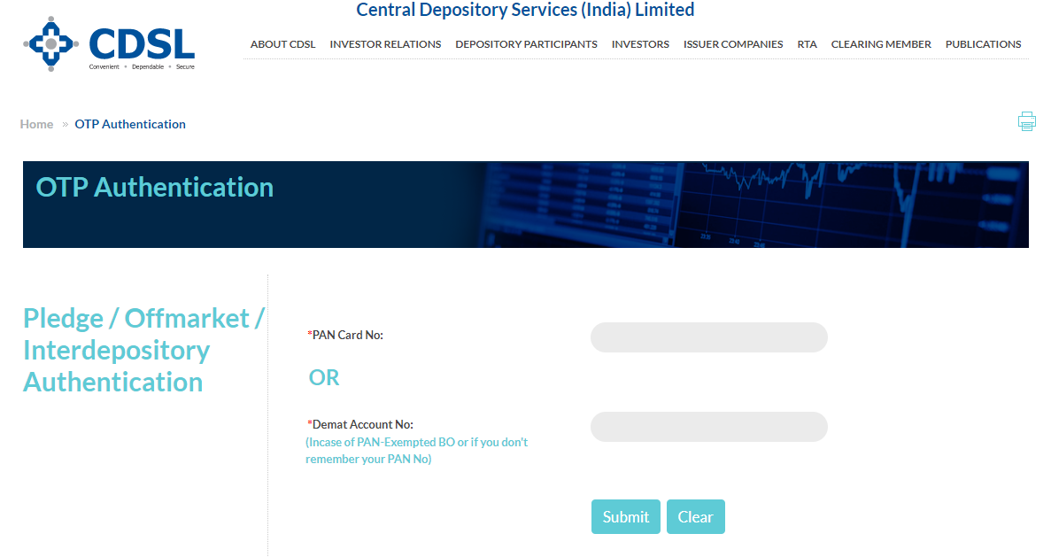

At all times while placing GTT, you are required to maintain sufficient cash balance and sufficient quantity of holdings of the respective scrip in Your trading account, such that; all Your GTT’s may be successfully triggered, as per the Trigger Conditions set by You. In case there is insufficient cash balance or insufficient quantity of holdings with respect to your GTTs at any point of time in your trading and demat account, your GTTs may be cancelled at the sole discretion of ProStocks and the ProStocks RMS. In case you are using EDIS , make sure that you do EDIS each day before market opens against your sale delivery GTT order.

There are various checks that the RMS at ProStocks does on a pre-trade basis as and when clients request orders to be placed, but before orders are placed at the Exchanges. All such checks are done as per the rules of the Exchanges, SEBI and ProStocks’s internal risk management policies and procedures.

The Call and Trade feature at ProStocks shall not be allowed for clients using the GTT Feature.

At a particular point of time, You / each client may only have a maximum of 100 pending GTTs.

There are two types of GTT Features:

- Single trigger: A single trigger price entered by You, which may be used to trigger either a target order (if LTP selected is higher than the current market price) or a stop loss order (if LTP selected is lower than the current market price)

- “OCO” - One cancels other: This feature type is applicable for stocks which are already in your current holdings. Two trigger prices can be entered by you, where one trigger price would be above the current market price behaving as a target price and one trigger price would be below the current market price behaving as a stop loss price.

Triggers under both the types: Single and OCO would be triggered as per the Trigger Price and Trigger Conditions selected by you.

Orders may not be placed, may be rejected or cancelled, may not be executed, even if Trigger Conditions are met, as per the GTT Feature, in the below mentioned market timings/conditions:

- In case the Trigger Price is breached during any day (which may be caused due to a gap up or gap down opening at market opening), an order shall be placed at the limit price selected by you and shall be cancelled at the end of such trading session; in case such limit price is not met during the day;

- In case the minimum difference between Trigger Price selected and the LTP at that point of time, is not as per Clause 1.5;

- All GTT’s are cancelled after 365 days from placing such request in case they are not triggered as per the Trigger Conditions;

- In case there is a change in exchange series or any corporate action, such as; splits, bonuses, dividends of extraordinary nature (above 5% of market price), merger, reverse mergers, amalgamations, takeover, delisting, rights issue, etc. where there is a significant impact/change in the scrip price, the GTT may be cancelled at the sole discretion of ProStocks, 1 day prior to the Ex-date of such corporate action effect taking place on the stock price. The action of cancelling such an order request through the GTT Feature shall be at the sole discretion of ProStocks and ProStocks RMS;

- Order requests being placed through the GTT Feature, once the Trigger Price is breached and such limit price selected is outside the circuit limits of the particular scrip;

- Scrips falling under the Call Auction list by NSE are not to be used under the GTT Feature. The list is updated by NSE and the latest list of such scrips can be viewed here.

Once a GTT is triggered for a derivative contract, if the order is placed outside of the contract's "execution range" it may be cancelled the by the exchange. Any cost You may incur due to such cancellation of an order placed outside the execution range is liable to be paid by You.

If a GTT is triggered for an option contract that isn't allowed for trading by ProStocks, the order may be rejected.

The onus of checking for a pending GTT for a scrip before placing any new order(s) for the same scrip from the order window, positions page, or via call and trade.

GTTs for derivative contracts are only valid for the lifetime of the contract. Pending GTTs for a contract will be invalidated one day after the expiry of the contract.

Charges for Usage of GTT Feature type

As an introductory offer, there shall be no charges levied on requesting orders through the GTT Feature for the first 3 months, for all clients of ProStocks.

ProStocks, at its sole discretion, shall be allowed to decide the pricing/brokerage for placing the GTTs; as and when the introductory offer period ends.

Risks, Non execution and Applicable law

This GTT order does not assure execution of an order and includes/involves all risks with respect to Internet Based Trading, and risks with respect to trading in the Capital Markets segments will extend to trading using the GTT orders as well.

Please make sure to once again read and understand the terms, conditions and points under the Equity Annexure and Risk Disclosure Document, which You have already agreed to while opening Your trading account with ProStocks.

ProStocks is a stock broking entity registered with SEBI under the registration number INZ000048660 INDP2802016, and a member of NSE and BSE. Therefore, all rules and regulations prescribed by SEBI and the Exchanges would have to strictly be followed by You while placing instructions through ProStocks. All other laws and regulations as per the Republic of India would be applicable.

No Liability for Any Non-Execution or Any Lost Opportunity

ProStocks, at all times, bears no liability towards You for any reason whatsoever with respect to using the GTT Feature; including but not limited to, non-execution of any order using the GTT Feature / either leg of the order, any opportunity loss for non-execution of such orders/trades, any cancellation or non-placement of any orders, and any such other claims which may arise from You with respect to using the GTT Feature.

Subject to Change

This Terms of Usage and the Service of ProStocks placing orders under the GTT Feature, may be removed/modified/replaced at any point of time without providing any prior notification to You. It is Your responsibility to review this Terms of Usage every time You use the GTT Feature.

How does Bracket Order work?

Bracket Order (BO) is a type of order where you can enter a new position (intraday only) along with a target/exit and a stop-loss order. As soon as the main order is executed, the system will place two more orders (profit-taking and stop-loss). When one of the two orders (profit taking or stop loss) gets executed, the other order will get cancelled automatically.

Terms of Usage – Bracket Order (BO)

These Terms of Use govern the usage of services of the Bracket Order. By agreeing to use Bracket Order, you agree to have read and understood these clauses, conditions, the modalities of how Bracket Order clearly works, and ProStocks’s policies, procedures and risk disclosure documents.

Definitions

- “Intraday” means opening and closing the position within one trading session on the same day.

- “Last Traded Price” or “LTP” is the last traded price at which a stock/scrip was traded on the Exchange and received by our server.

- “Limit Order”, "Market Order”, "Stop Loss order" , "Stop Loss market Order" or order shall be defined as per the NSE “Order Conditions” which can be found here.

- “RMS” or “Risk Management System” is the system in place at ProStocks which monitors all positions of ProStocks clients on a real time basis and sees to it that clients maintain margins with respect to all positions/positional trades and that ProStocks maintains margins at a broker/trading member level with the clearing houses. The RMS also constantly vets each order, on a pre-trade basis, placed by a client towards the exchanges to see whether the order is as per ProStocks’s risk management policies and procedures, and whether the client has placed such order with sufficient cash balances, holdings and as per the rules set by and the Exchanges. The RMS continuously enforces ProStocks’s terms, policies and procedures, by enforcing limits of margins/squaring off positions with respect to each client, as per the risk management policies followed by ProStocks. You, as a client, are required to always be updated with ProStocks’s risk management policies, terms, and procedures.

Terms and Conditions (Bracket Order)

The client agrees that Bracket Order is an additional facility being provided by ProStocks and the client understands he can place multiple orders one after the other instead of placing a multi-leg bracket order.

Bracket order is currently available from 09:11 am to 3:15 pm – these timings may be amended as per ProStocks’ discretion, without any prior notice and without assigning any reasons for the same. ProStocks shall not be responsible for any costs/losses, direct or indirect, arising out of non-availability of such Bracket order.

The client acknowledges that in the case the position is not squared off till 3:15 pm or any such other time that ProStocks, may at its sole discretion decide, ProStocks shall endeavour to square off the open position. In case the said position is not squared off before the closure of the market, the position shall be carried forward to the next day. In such cases the clients shall be responsible for ensuring the adequate margins are available in the client’s account with ProStocks in order to ensure there is no shortfall. In case there is a margin shortfall, the positions may be squared off based on the risk management policy of ProStocks.

ProStocks does not guarantee that the orders will be successfully placed for square-off of all open positions or that orders place for square-off shall be executed. In case the positions are not squared off for any reasons beyond the control of ProStocks, such as price band, technical glitches, software malfunctions, etc. the same may result into delivery. The client fully understands that such situations might result in additional margin requirements and pay-in obligations from the client for funds and securities and client would have to honour such obligations. All costs/expenses/charges arising out of such obligations/ failure to meet such obligations shall be borne by the client.

Further, the client agrees that any cost, including, interest, additional brokerage, penalty on margin shortfall etc, on account of carry forward of the positions shall be the sole responsibility of the client.

The client acknowledges that any loss on account of such delay in square off, whether actual or otherwise shall be the sole responsibility of the client. ProStocks shall not be liable for the same.

Although ProStocks shall take best efforts to square off all the unexecuted orders within timeliness provided, however, technical/system related/ communication failure issues or other glitches and constraints beyond control of ProStocks may prevent ProStocks from squaring off the same within timelines and that in such scenarios, ProStocks shall not be held liable for any losses incurred thereon.

Loss suffered, if any, in the course of the said trading will have to be borne by the client only and ProStocks, its associates, directors or employees shall not be responsible whatsoever for the same.

Charges for Usage of GTT Feature type

As an introductory offer, there shall be no charges levied on Bracket Orders for the first 3 months, for all clients of ProStocks.

ProStocks, at its sole discretion, shall be allowed to decide the pricing/brokerage for placing Bracket Orders; as and when the introductory offer period ends.

Risks, Non execution and Applicable law

Bracket Order does not assure execution of an order and includes/involves all risks with respect to Internet Based Trading and risks with respect to trading in the Capital Market segment will extent to Bracket Order as well.

To note: When markets are volatile, sometimes both target and stop loss orders get executed instantly – this could result in an additional open position – in any such case ProStocks will not be liable for any losses, if any, and will have to be borne by the client only and ProStocks, its associates, directors or employees shall not be responsible whatsoever for the same.

Please make sure to once again read and understand the terms, conditions and points under the Equity Annexure & Risk Disclosure Document, which you have already agreed to while opening your trading account with ProStocks.

ProStocks is a stock broking entity registered with SEBI under the registration number INZ000048660 INDP2802016, and a member of NSE and BSE. Therefore, all rules and regulations prescribed by SEBI and the Exchanges would have to strictly be followed by you while placing instructions through ProStocks. All other laws and regulations as per the Republic of India would be applicable.

No Liability for Any Non-Execution or Any Lost Opportunity

ProStocks, at all times, bears no liability towards you for any reason whatsoever with respect to using Bracket Orders; including but not limited to, non-execution of any order using Bracket Orders / either leg of the order, any opportunity loss for non-execution of such orders/trades, any cancellation or non-placement of any orders, and any such other claims which may arise from you with respect to using Bracket Orders.

Subject to Change

ProStocks reserves the rights to modify all or any of the terms and conditions at any time. Updated terms and conditions would be available in the online login of the client on the website www.prostocks.com/" target="_blank">www.prostocks.com.

How does Cover Order work?

Cover Order (CO) is two leg orders where the first leg of the order creates position and second leg of the order is position off setting/closing stop loss order. As the name suggests, second leg stop loss order gives cover or protection to losses which may arise from the first leg order, hence called Cover Order (CO). Cover Order has inbuilt protection. Cover order is a synthetic order and is not supported by the Exchange API and is created by combining one normal or regular order with one stop loss order, hence synthetic order.

- “Last Traded Price” or “LTP” is the last traded price at which a stock/scrip was traded on the Exchange and received by our server.

- “Limit Order”, "Market Order”, "Stop Loss order" , "Stop Loss market Order" or order shall be defined as per the NSE “Order Conditions” which can be found here.

- “RMS” or “Risk Management System” is the system in place at ProStocks which monitors all positions of ProStocks clients on a real time basis and sees to it that clients maintain margins with respect to all positions/positional trades and that ProStocks maintains margins at a broker/trading member level with the clearing houses. The RMS also constantly vets each order, on a pre-trade basis, placed by a client towards the exchanges to see whether the order is as per ProStocks’s risk management policies and procedures, and whether the client has placed such order with sufficient cash balances, holdings and as per the rules set by and the Exchanges. The RMS continuously enforces ProStocks’s terms, policies and procedures, by enforcing limits of margins/squaring off positions with respect to each client, as per the risk management policies followed by ProStocks. You, as a client, are required to always be updated with ProStocks’s risk management policies, terms, and procedures.

Terms and Conditions (Cover Order)

The client agrees that Cover Order is an additional facility being provided by ProStocks and the client understands he can place multiple orders one after the other instead of placing a multi-leg Cover order.

Cover order is currently available from 09:11 am to 3:15 pm – these timings may be amended as per ProStocks’ discretion, without any prior notice and without assigning any reasons for the same. ProStocks shall not be responsible for any costs/losses, direct or indirect, arising out of non-availability of such Cover order.

The client acknowledges that in the case the position is not squared off till 3:15 pm or any such other time that ProStocks, may at its sole discretion decide, ProStocks shall endeavour to square off the open position. In case the said position is not squared off before the closure of the market, the position shall be carried forward to the next day. In such cases the clients shall be responsible for ensuring the adequate margins are available in the client’s account with ProStocks in order to ensure there is no shortfall. In case there is a margin shortfall, the positions may be squared off based on the risk management policy of ProStocks.

ProStocks does not guarantee that the orders will be successfully placed for square-off of all open positions or that orders place for square-off shall be executed. In case the positions are not squared off for any reasons beyond the control of ProStocks, such as price band, technical glitches, software malfunctions, etc. the same may result into delivery. The client fully understands that such situations might result in additional margin requirements and pay-in obligations from the client for funds and securities and client would have to honour such obligations. All costs/expenses/charges arising out of such obligations/ failure to meet such obligations shall be borne by the client.

Further, the client agrees that any cost, including, interest, additional brokerage, penalty on margin shortfall etc, on account of carry forward of the positions shall be the sole responsibility of the client.

The client acknowledges that any loss on account of such delay in square off, whether actual or otherwise shall be the sole responsibility of the client. ProStocks shall not be liable for the same.

Although ProStocks shall take best efforts to square off all the unexecuted orders within timeliness provided, however, technical/system related/ communication failure issues or other glitches and constraints beyond control of ProStocks may prevent ProStocks from squaring off the same within timelines and that in such scenarios, ProStocks shall not be held liable for any losses incurred thereon.

Loss suffered, if any, in the course of the said trading will have to be borne by the client only and ProStocks, its associates, directors or employees shall not be responsible whatsoever for the same.

Charges for Usage of GTT Feature type

As an introductory offer, there shall be no charges levied on Cover Orders for the first 3 months, for all clients of ProStocks.

ProStocks, at its sole discretion, shall be allowed to decide the pricing/brokerage for placing Cover Orders; as and when the introductory offer period ends.

Risks, Non execution and Applicable law

Cover Order does not assure execution of an order and includes/involves all risks with respect to Internet Based Trading and risks with respect to trading in the Capital Market segment will extent to Cover Order as well.

Please make sure to once again read and understand the terms, conditions and points under the Equity Annexure and Risk Disclosure Document, which you have already agreed to while opening your trading account with ProStocks.

ProStocks is a stock broking entity registered with SEBI under the registration number INZ000048660 INDP2802016, and a member of NSE and BSE. Therefore, all rules and regulations prescribed by SEBI and the Exchanges would have to strictly be followed by you while placing instructions through ProStocks. All other laws and regulations as per the Republic of India would be applicable.

No Liability for Any Non-Execution or Any Lost Opportunity

ProStocks, at all times, bears no liability towards you for any reason whatsoever with respect to using Cover Orders; including but not limited to, non-execution of any order using Cover Orders / either leg of the order, any opportunity loss for non-execution of such orders/trades, any cancellation or non-placement of any orders, and any such other claims which may arise from you with respect to using Cover Orders.

Subject to Change

ProStocks reserves the rights to modify all or any of the terms and conditions at any time. Updated terms and conditions would be available in the online login of the client on the website www.prostocks.com/" target="_blank">www.prostocks.com.

Hits: 60732