Margin Pledge and Repledge (MPR) is a process that allows you to use your Demat holdings as collateral to obtain trading margins from ProStocks. Here’s how it works:

-

Pledging Securities:

When you want to trade with ProStocks, you need to maintain margins for your trades. These margins can be in the form of cash or stocks.

In the traditional system, when a client wants to pledge their stocks to obtain margins, they transfer the securities from their Demat account to the broker’s account. The broker then pledges these securities to the Clearing Corporation.

However, this transfer of title (ownership) of the securities leaves room for potential misuse by certain brokers.

-

The New Pledge System:

To address this issue, a new pledge system was introduced, which went live from August 1, 2020.

In this new system, the stocks do not leave the investor’s Demat account. Instead, a pledge is marked in favor of the broker.

The broker is required to open a separate Demat account labeled ‘TMCM – Client Securities Margin Pledge Account’ for this purpose (TMCM stands for Trading Member Clearing Member).

The broker then re-pledges these securities in favor of the Clearing Corporation and obtains margins.

-

Benefits of the New Pledge System:

No Misuse of Securities: Since the stocks remain in the investor’s account, there is less chance of misuse of securities. It also prevents the possibility of pledging one client’s stocks to offer margin to a different client.

Corporate Actions: In the new pledge system, the client receives all cash and non-cash corporate actions (such as dividends, bonus, rights, etc.) because the stocks are held in the client’s collateral account.

-

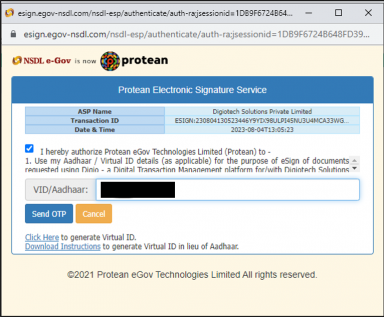

What is the process of margin pledge and re-pledge?

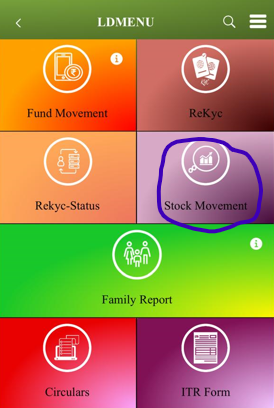

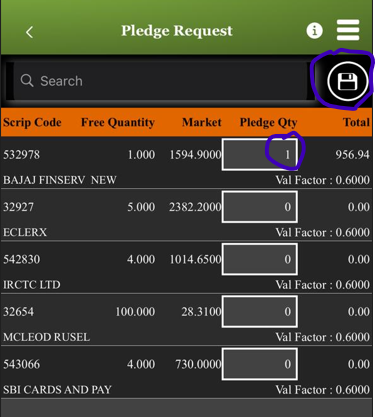

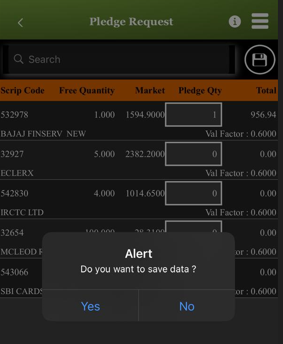

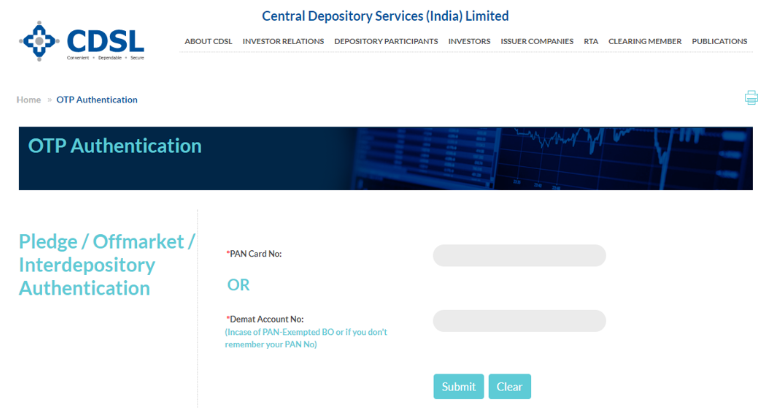

What is the process of margin pledge and re-pledge through the trading platform?

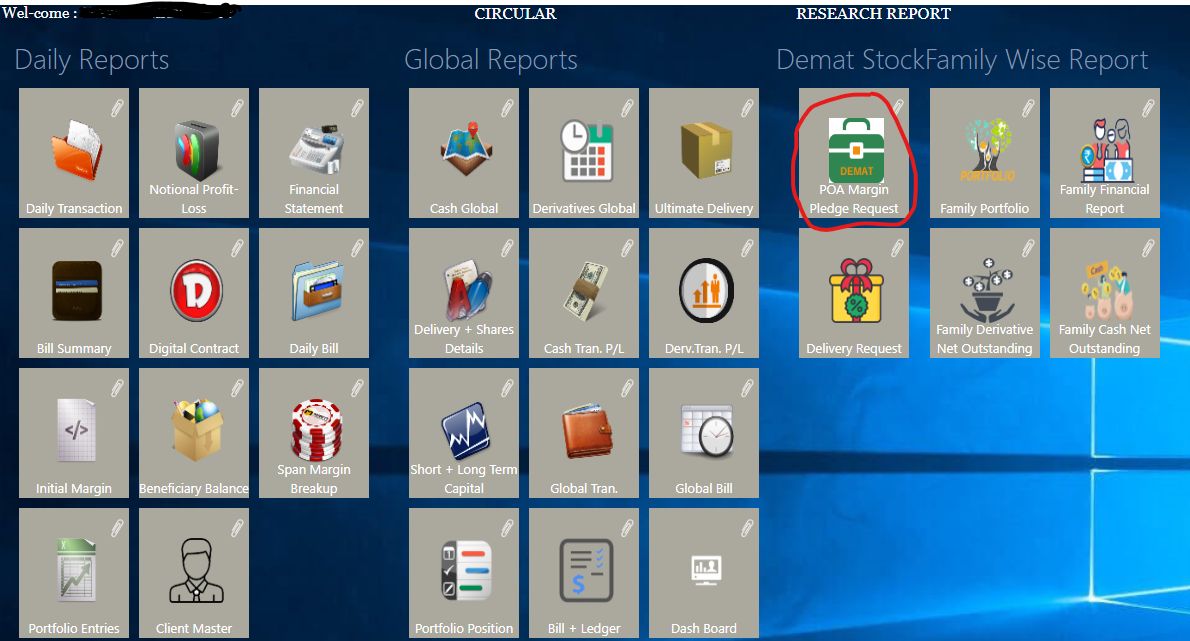

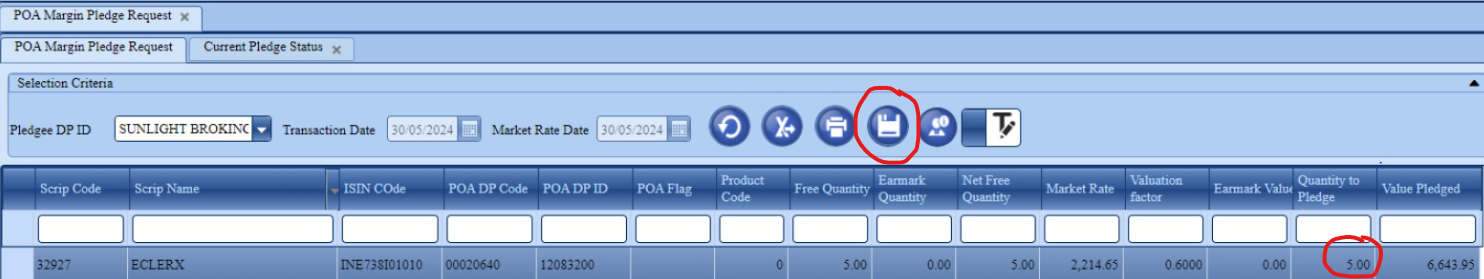

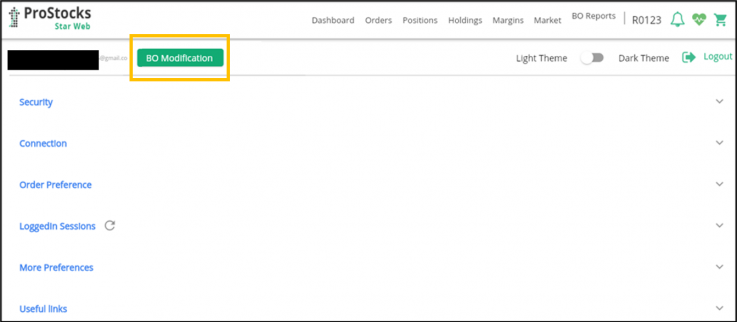

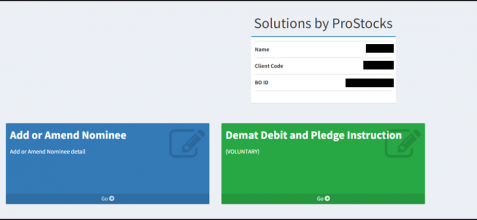

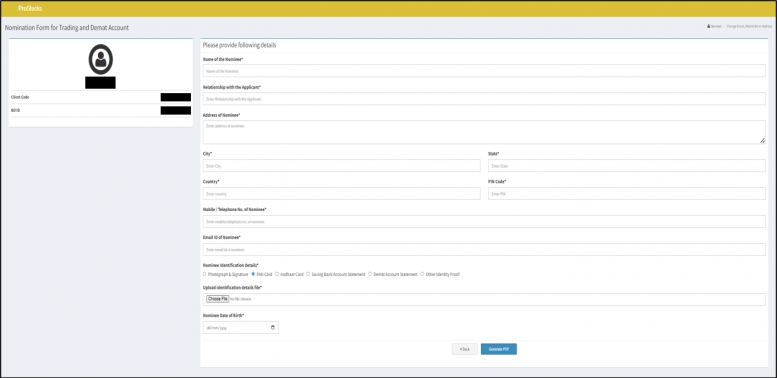

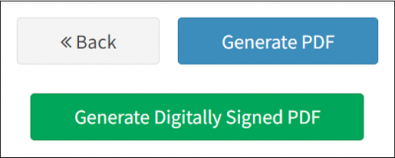

What is the process of margin pledge and re-pledge through Back-Office?

Please note that the new pledge/re-pledge mechanism enhances investor safety by minimizing the risk of securities misuse and ensuring transparency in the process. If you have any more questions or need further clarification, feel free to ask us!

Comment (0) Hits: 21992