Dear Client,

As part of SEBI and Exchange directives (Ref: NSE/INSP/68566, dated June 16, 2025), we at ProStocks would like to inform you about the updated regulatory framework regarding the offering of third-party products (TPPs) through our platform or any related application.

What You Need to Know

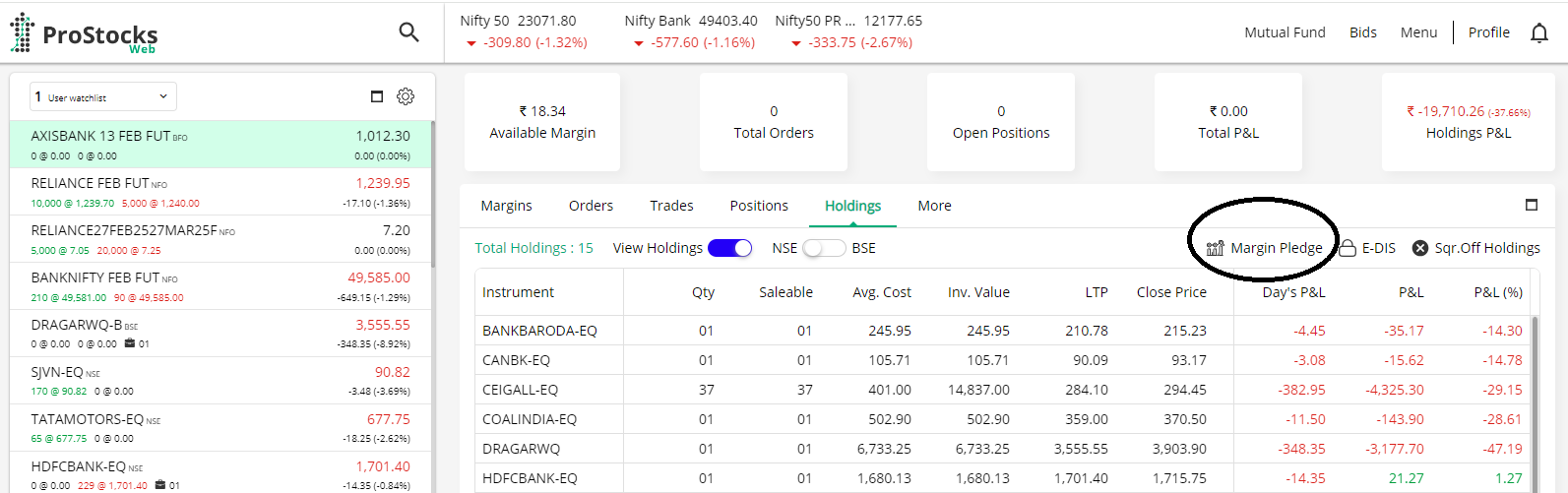

- Only Regulated Products: We will only offer products that are regulated by SEBI or other financial regulators like IRDAI, PFRDA, or RBI.

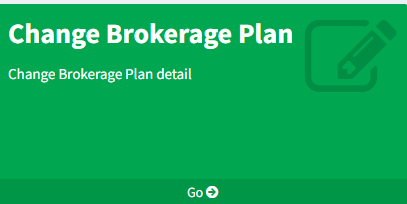

- Disclosure & Transparency: All third-party products will be displayed under a separate tab/page with full details including the name of the product and the registration number of the regulator.

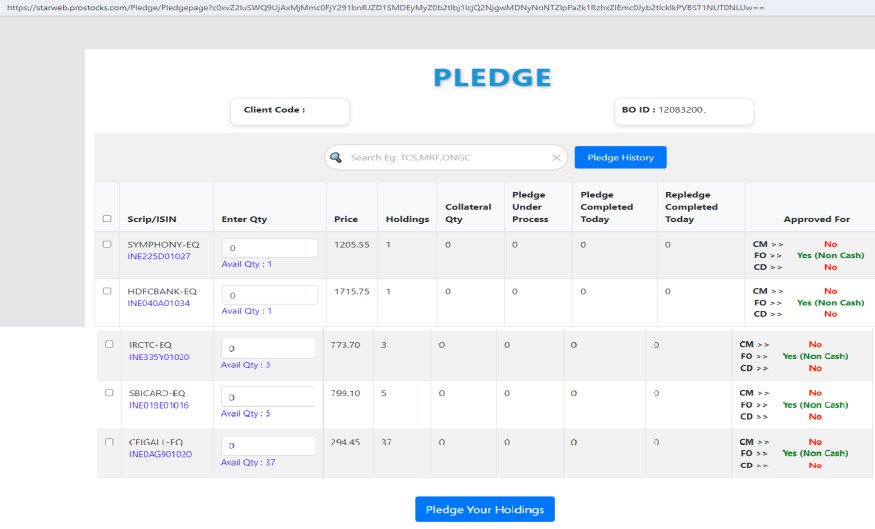

- Your Data is Secure: Your personal and trading data will remain secure with us. It will not be shared with any third-party provider without your explicit, opt-in consent.

- Payments Stay Direct: Any payments you make for third-party products will go directly to the product provider. Funds will not pass through ProStocks unless explicitly allowed by regulators (like for NPS).

- No Bundling or Mandates: You are under no obligation to use any of the third-party offerings. These are entirely optional and not linked to your trading account.

- No Tripartite Agreements: ProStocks will not be a party to any agreement you enter into with a third-party product provider.

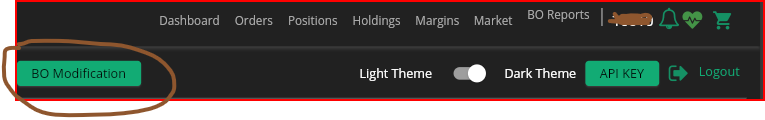

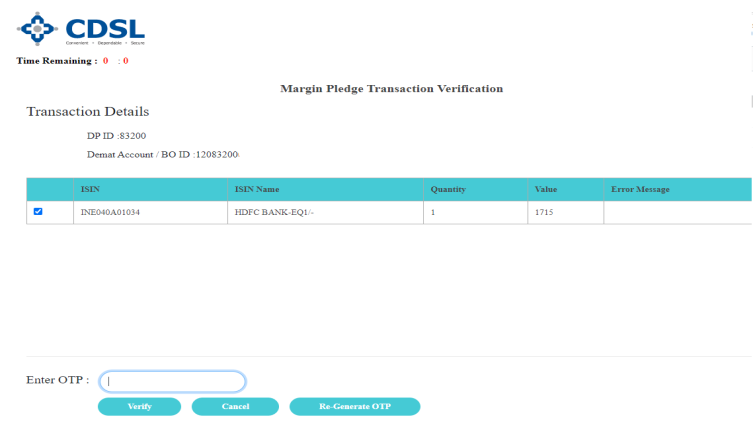

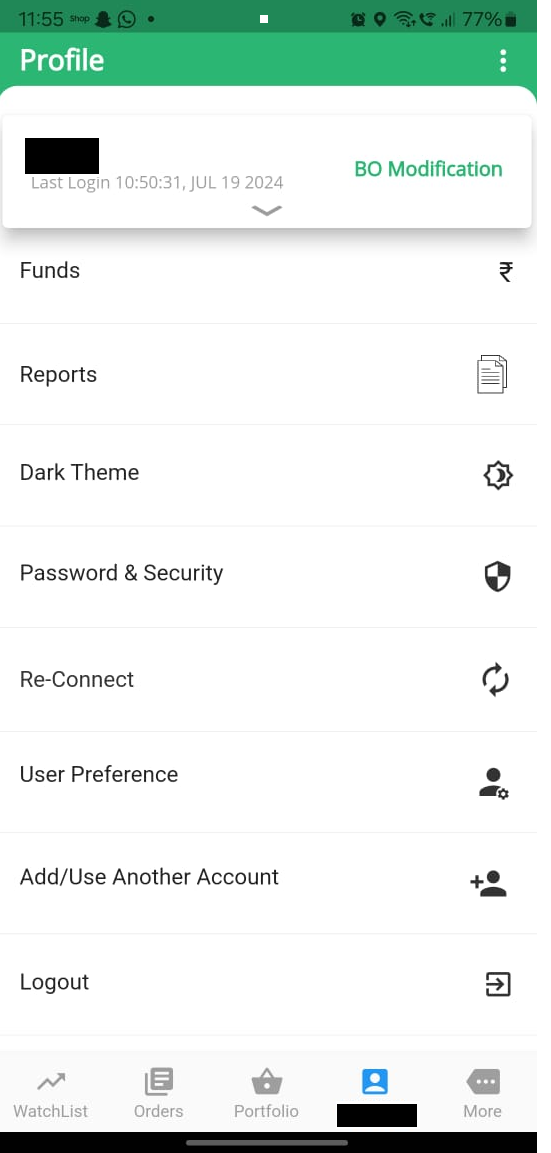

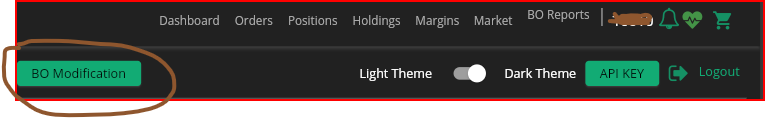

- Login Security: Access to the broking section of our app or platform will always be protected by two-factor authentication (2FA), as mandated by SEBI and stock exchanges.

For Your Protection

We want to ensure you are empowered with choice, and protected by regulation. Our platform is committed to providing you with a seamless and secure experience — whether you're trading or exploring optional financial services.

For any questions or concerns, feel free to reach out to our support team.

Warm regards,

Team ProStocks